July 2025 Austin Market Stats: Pending Sales Up, Inventory Jumps

- Aug 14, 2025

- 2 min read

July real estate stats for the Austin Metro are in! Here's what you need to know.

July brought us a mixed bag of market indicators — some up, some down, and a lot that stayed steady. While sales dipped slightly, pending contracts point toward more activity in the coming months. We also saw a jump in new listings which has given Buyers some new choices. Sellers, on the other hand, are navigating a market that’s balanced on paper but feels softer in practice.

Key Highlights:

Total sales declined -4% Year-over-Year, but ending Units increased +9% Year-over-Year, suggesting stronger sales ahead.

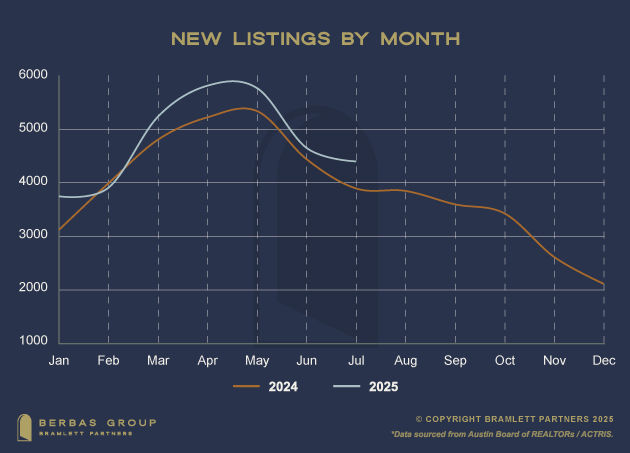

New Listings jumped +13% Year-over-Year, pushing Months of Inventory up 19% to 5.3 months.

Average Days on Market increased to 72.5 days (from 64.7 in 2024).

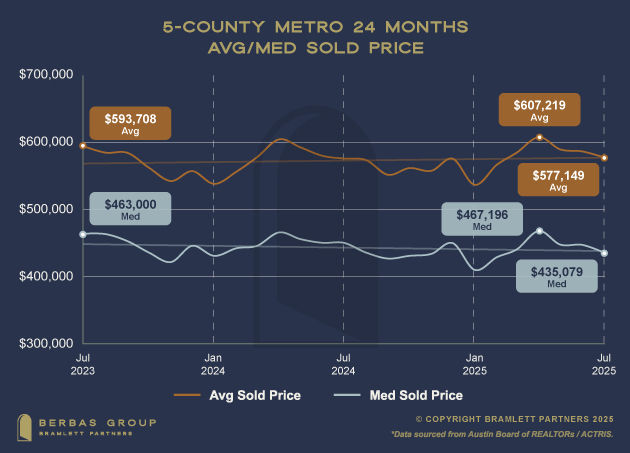

Average Sold Price rose slightly Year-over-Year, but Median Sold Price dipped -2.5%.

Price per Square Foot declined: Average is down -3%, Median is down -4.4%.

Average & Median Pricing Remain Flat

July’s numbers keep telling the same story we’ve seen for two years: pricing stability. Over the last 24 months, the average sold price has ticked up slightly, while the median sold price has inched down — essentially forming a “pancake-flat” trend line. This stability makes both buying and selling relatively “safe” from a pricing volatility perspective.

Pending Units See a Seasonal Bump

Pending units — one of the best leading indicators we track — rose in July compared to last year. This is a welcome sign, even though we’re heading into the predictable late-summer/holiday slowdown. Seasonality is alive and well! So we expect demand to taper through year-end before rebounding in spring 2026.

New Listings Outpace Demand

While demand improved in July, supply grew even faster. New listings increased 13% Year-over-Year, which helped push Months of Inventory from 4.5 to 5.3. For sellers, this means a sharper pricing strategy is critical, especially in slower sub-markets.

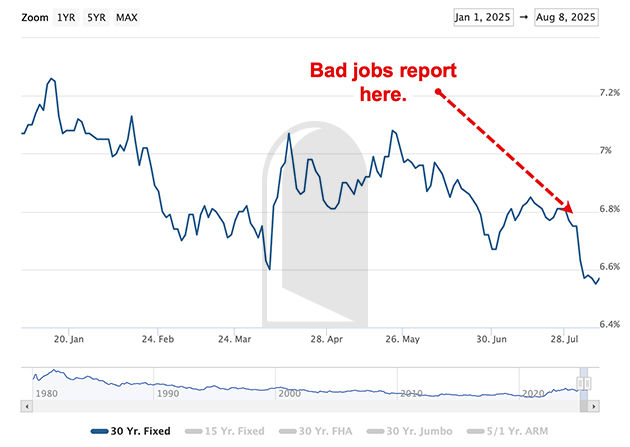

Broader Economic Indicators Offer Mixed Signals

Consumer sentiment rebounded in June and July after spring’s tariff-related dip, but it’s still below pre-March levels. The recent negative jobs report has markets betting on more aggressive Fed rate cuts — three instead of two in 2025 — with a near 90% probability of the first cut in September. Mortgage rates reacted quickly, dropping to just over 6.5%, which could help stimulate demand heading into fall.

If You’re a Buyer

Inventory is up, rates just dipped, and pricing has been stable for two years. You have negotiating room in many sub-markets, and you’re less likely to face bidding wars than in past years. Just keep in mind that spring typically brings more competition.

If You’re a Seller

Seasonality is not on your side right now, so pricing ahead of the market is key. If you need to sell before year-end, preparation and competitive pricing are essential. If you can wait, spring 2026 should bring stronger demand.

Our goal as your trusted real estate advisors is to provide you with the information you need to help you reach your investment goals.

As always, real estate is hyperlocal and extremely situational, so please reach out to us to discuss your specific situation. We’d love to help you and strategize what’s in your best interest.

Cheers!

© 2025 Berbas Group. All rights reserved.

This is a clear mission statement that focuses correctly on the core value of advisory!

Real estate is a challenging field because it requires investors to simultaneously observe both the macroeconomic picture (interest rates, inflation) and the microscopic details (schools, neighborhood planning). This combination is the art of strategy development. How can advisors simultaneously provide broad information while maintaining focus on the "situational" nature without overwhelming clients with immense data? The process of building a successful real estate investment strategy demands a creative effort, combining harmonic elements and experimenting in various ways, producing a unique product from individual parts (macro and micro data). A Friday Night Funkin mindset is needed to combine these disparate information streams, synchronizing macroeconomic data with hyperlocal…

Hey, reading all these real estate stats can be exhausting, and sometimes I just needed a mental break from numbers and trends. That’s when I tried out https://plinko.com.my. I started cautiously and lost a few rounds, but after taking a slightly bigger risk I hit a satisfying win that really lifted my mood. What made it even better is that players from Malaysia get special bonuses, which adds an extra thrill to the experience. It’s become my little way to step back and relax before diving back into market data.

Hi there, I had this goal to get myself a decent gaming monitor, but saving bit by bit through online play wasn’t going anywhere. After a series of unlucky rounds, I gave https://plinko.co.za a try and raised the stakes a bit. To my surprise, it turned into a win that covered all my earlier losses. That rush kept me going, and now I’m closer than ever to affording the monitor. Honestly, it’s worth checking out.